- 3 minutes

Home >> Insights >> Case Studies >> Coles Supermarkets Case Study

Case Study: Coles Supermarkets

Australian advertiser Coles set a new benchmark for effective media measurement

Campaign's Challenges

In the complex world of media consumption, we face the challenge of accurately showing how and which media drives store visitations to retail. This project addressed head-on the biggest challenges in current media measurement: the lack of a single source of measurement across media channels, the inability to clearly link media metrics to tangible business objectives, all within a competitive context.

The grocery category in Australia is one of the most competitive and most concentrated in the world. Coles spends approximately AU$40-50M a year on advertising, and a significant proportion of this is spent over Christmas.

In the complex world of how people consume media nowadays, Coles face the huge challenge of showing ROI on their advertising investment. Efforts to determine this ROI have been made more difficult given:

- Lack of a single source of measurement across media channels.

- An inability to clearly link media metrics to tangible business objectives (such as

basket size or footfall). - Not having the information available in an easy, comparable competitive context. Further, the reliance on recall/memory of traditional survey-based. advertising approaches has the propensity to limit actionability, because respondents are unable to accurately discriminate between the specific creatives and channels that make up a campaign.

Campaign's Mission

- Identify opportunities to optimise media effectiveness across all Christmas creatives (approx. 150) and channels for the following year.

- Understand advertising brand impact.

- Demonstrate learning applied from last year creating efficiencies in media spend across 240 creatives.

- Link media spend to business objectives (footfall attribution).

- Understand the long-term vs short-term effects of advertising.

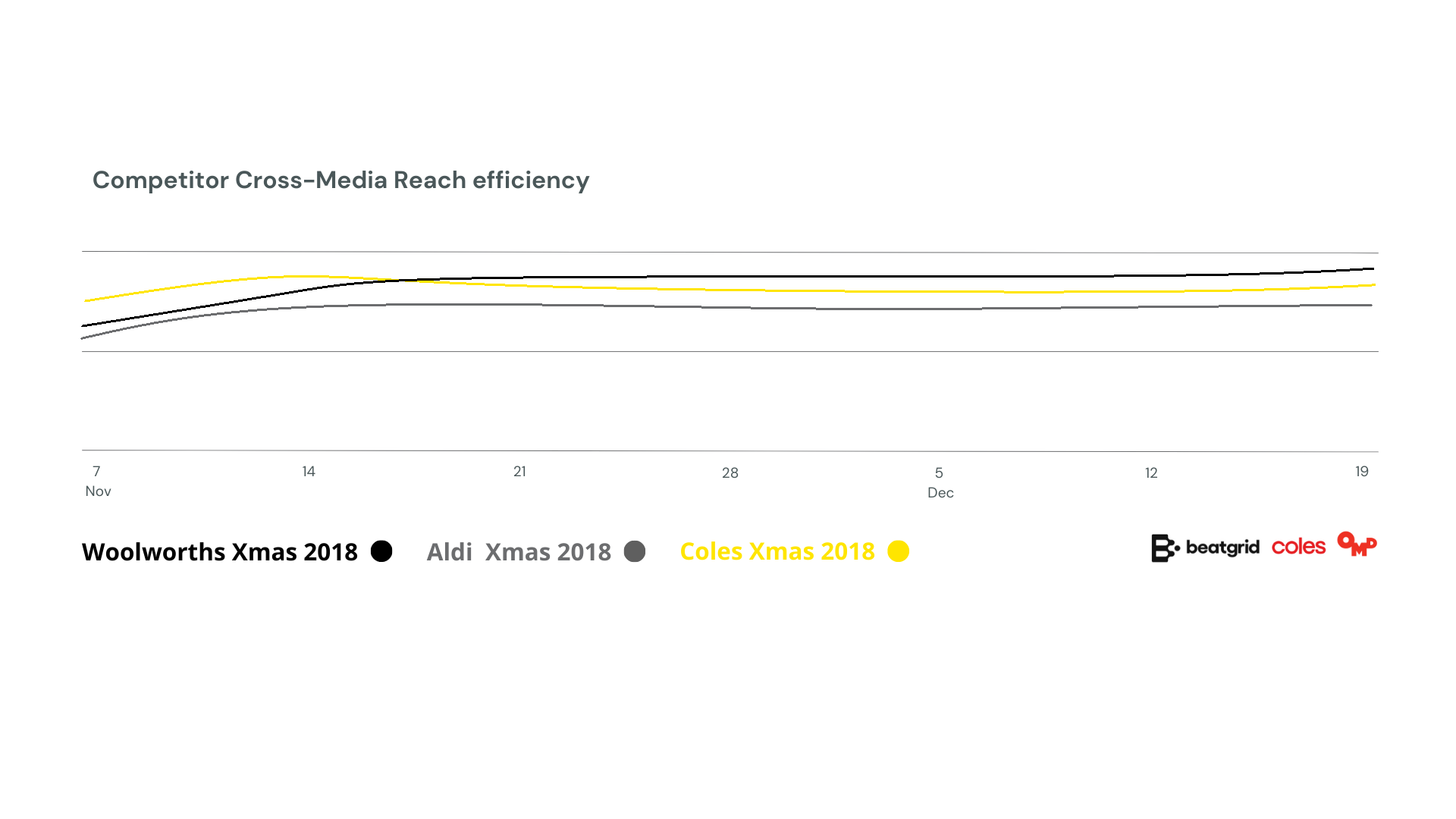

- Compare all of the above against the competitors in the category.

Panel Approach

Beatgrid has a GDPR compliant opt-in mobile panel of approx. 5,000 Australians, who have been invited to Beatgrid’s proprietary Media Rewards™ app.

As part of a dedicated cross-media panel, app users provide explicit opt-in for location tracking and audio matching, only for AV & OOH exposure measurement. No other data is collected or stored. PII is never used with media exposure data. In a post-GDPR, post-3rd party data world, high-quality deterministic panel data (from users that provide explicit permission) is now quickly being adopted as the “new” future-proof approach by the most progressive advertisers around the globe.

Measurement Technology

The passive-Automatic Content Recognition (ACR) technology runs in the background. It matches the audio fingerprint of each campaign creative against “audio fingerprinted” ambient sound, which is captured via their mobile phones (audio is never stored). The app also detects locations to accurately measure store visitation/footfall. Beatgrid’s technology is highly sophisticated and can identify unique creatives across different channels i.e. comparing a 15 sec TV ad versus a 10-sec Radio ad versus Cinema etc. This allowed Coles to understand the effectiveness of each creative. 150 ad creatives were tested in Year 1 and 270 in Year 2.

Results

Results were well over expectations, unearthing seven-figure savings in Year 1 that, when applied to Year 2, translated into a 10% lower media investment (or almost a seven-figure saving) while still being able to match competitor performance.

There was also an impressive 1600% ROI on the cost of the project against the savings achieved. Lessons learnt in the research are still being applied to Coles’ media strategy:

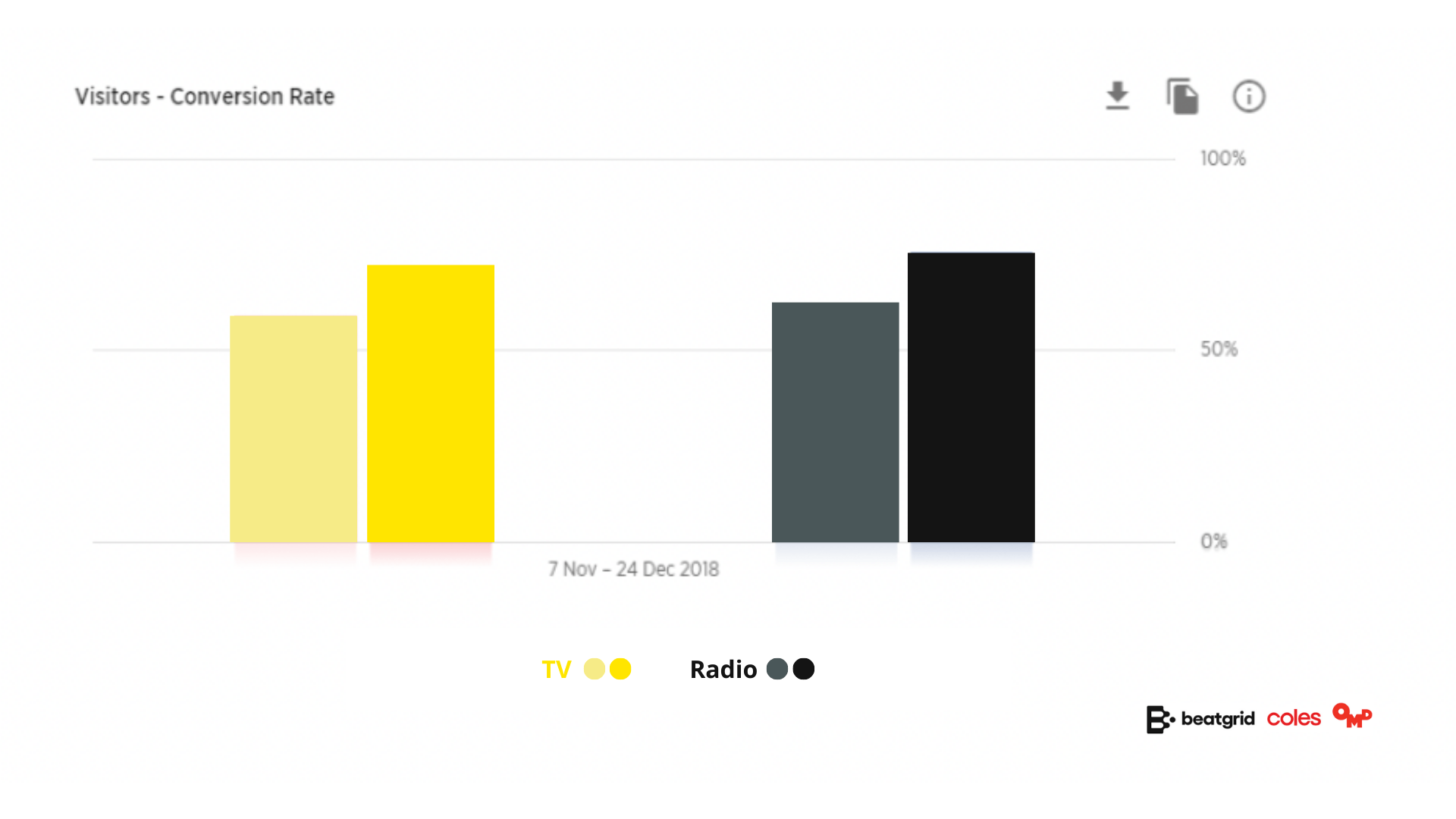

1- Coles was able to determine the optimal combination of channels to reach more people more effectively and efficiently. Radio proved to be most efficient, especially after applying the lessons learnt in Year 1.

However, the combination of TV and Radio proved to be the most effective, working even better after applying the lessons from the previous year.

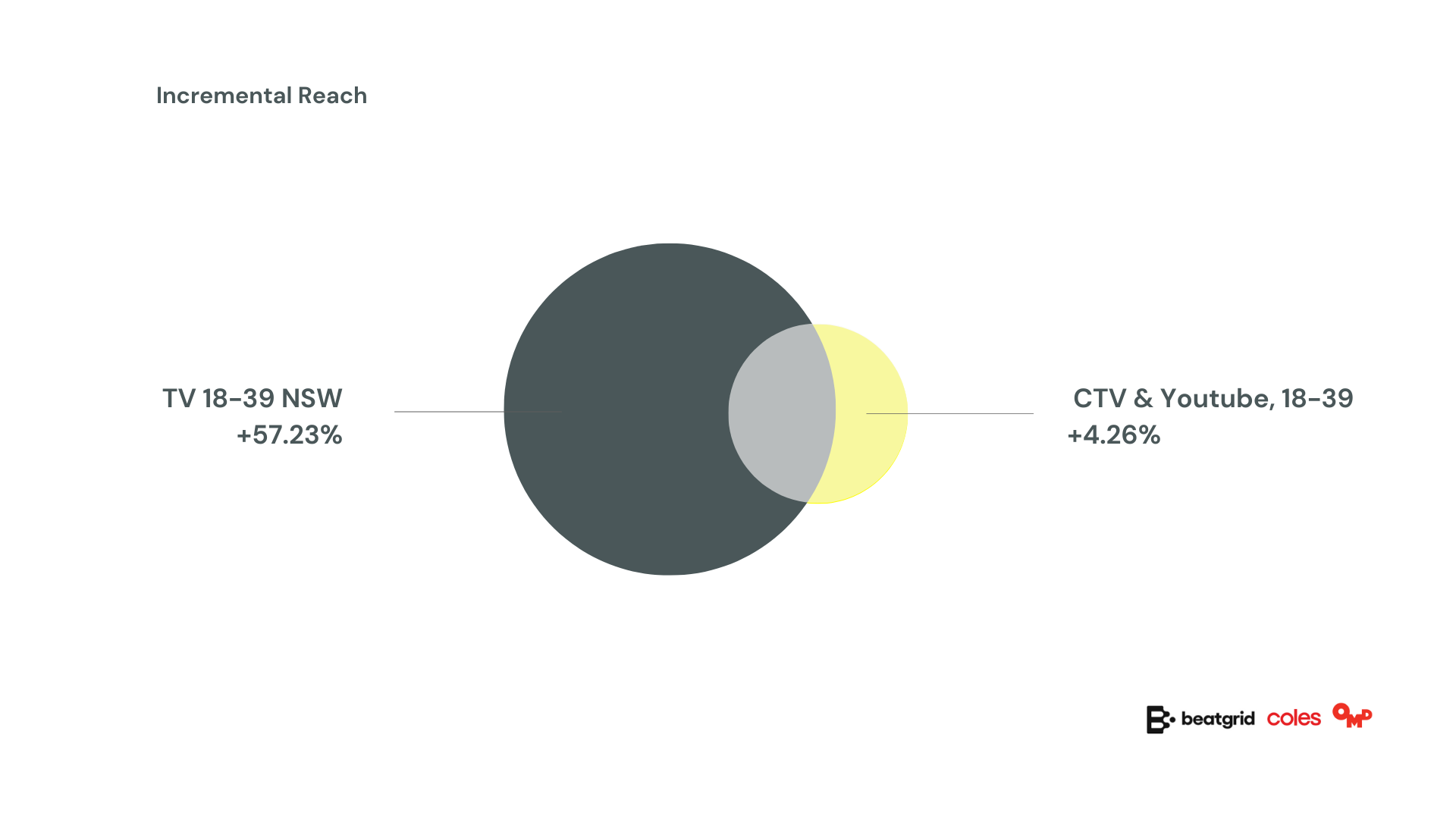

2- Coles was able to align the audience to channels more efficiently. The reach of TV varies by age with a 34-point difference in reach between those over 55 years old and those under 24. This helped to optimise the media plan by age.

Request a demo

Try a tailored single-source audience measurement solution to start improving your cross-media ROI.